County Council to Decide on Road/Bridge Referendum Recommendations

Greg Wilson/Anderson County

The next move on a penny sales-tax referendum is now up to Anderson County Council.

The six-member Anderson County Capital Project Sales Tax Commission finalized a proposal on Monday to allow Anderson County Council to offer voters a chance to fund road and bridge maintenance on the Nov. 4 ballot.

If approved, the one-percent sales tax would generate close to $380 million to fund a list of road/bridge projects the county and its municipalities have identified as the most critical places of need. The commission approved the list of projects as well as a bond issue of up to $20 million to accelerate the work.

The one-penny tax would expire in eight years, and the county hopes it will put a serious dent in the more than $350 million in backlogged road/bridge work, and potentially allow work to begin May 1, 2026. Groceries would be exempted from the tax.

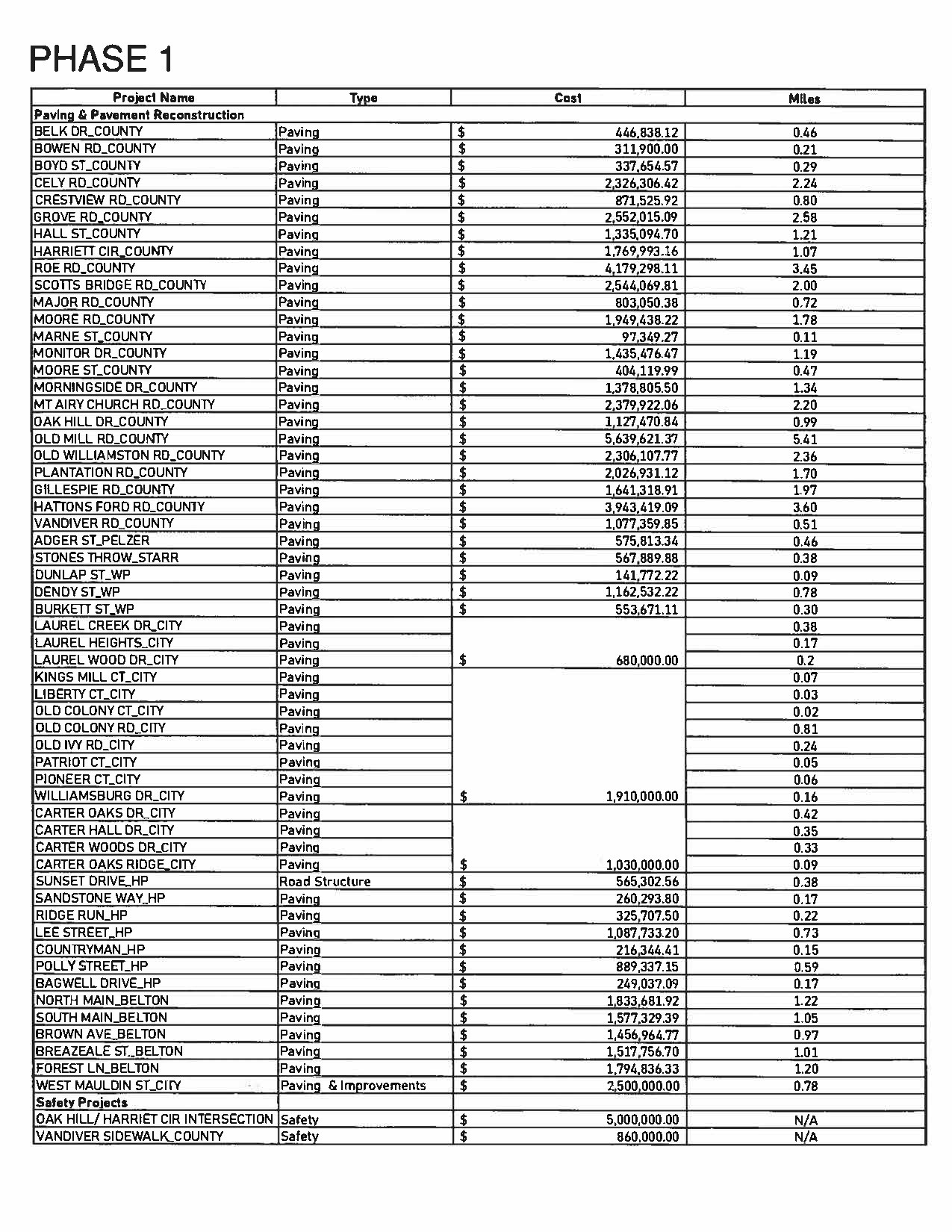

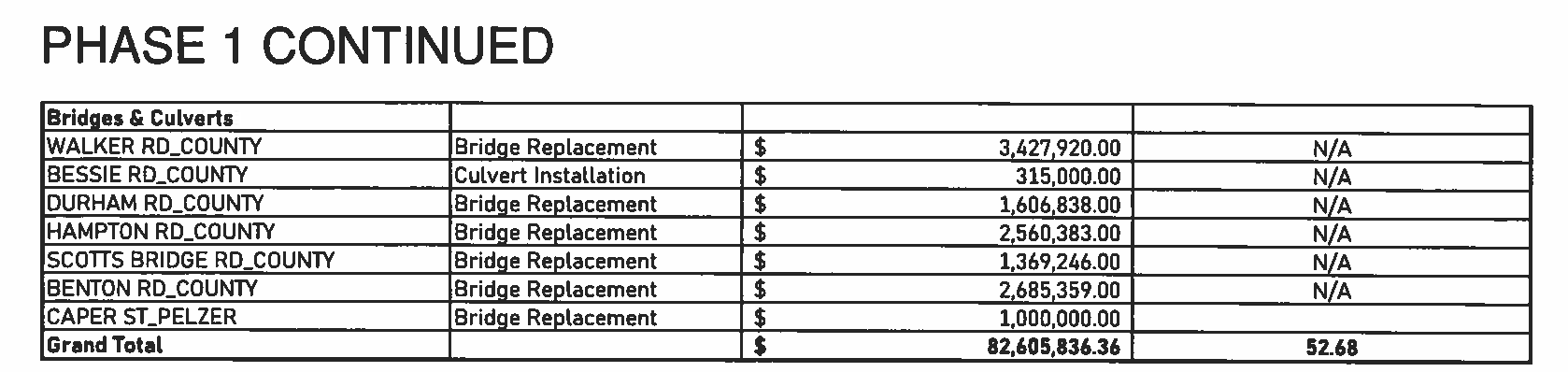

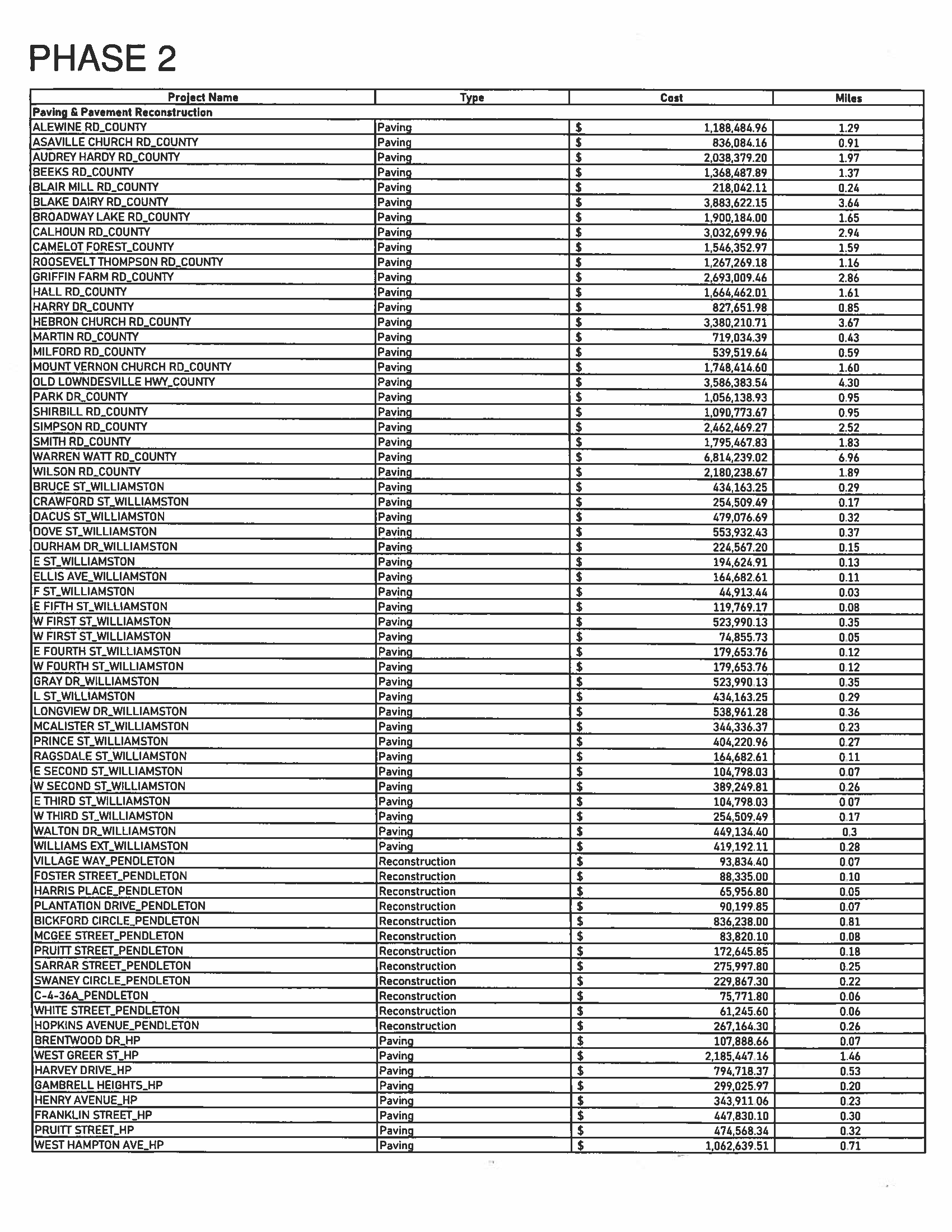

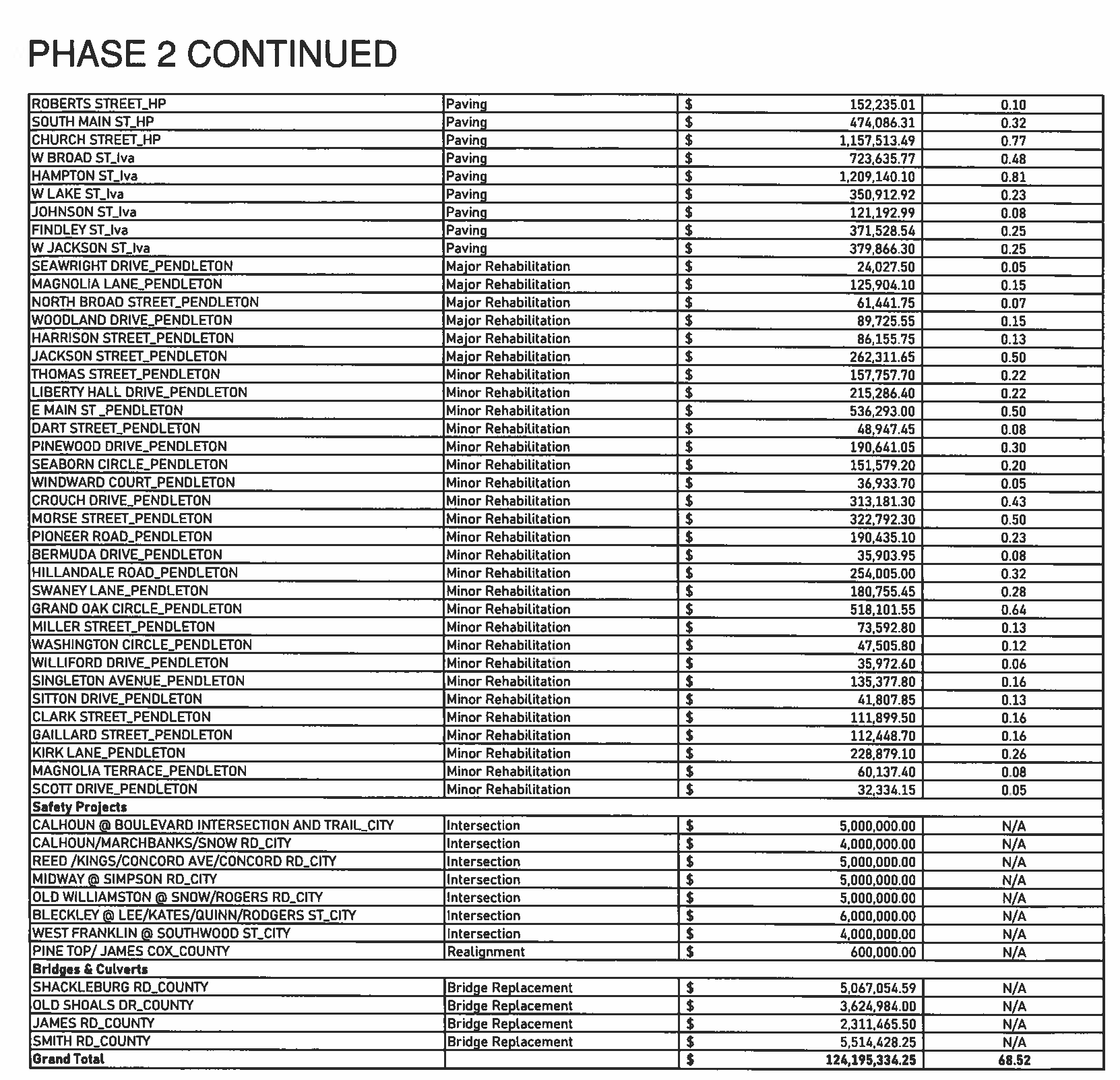

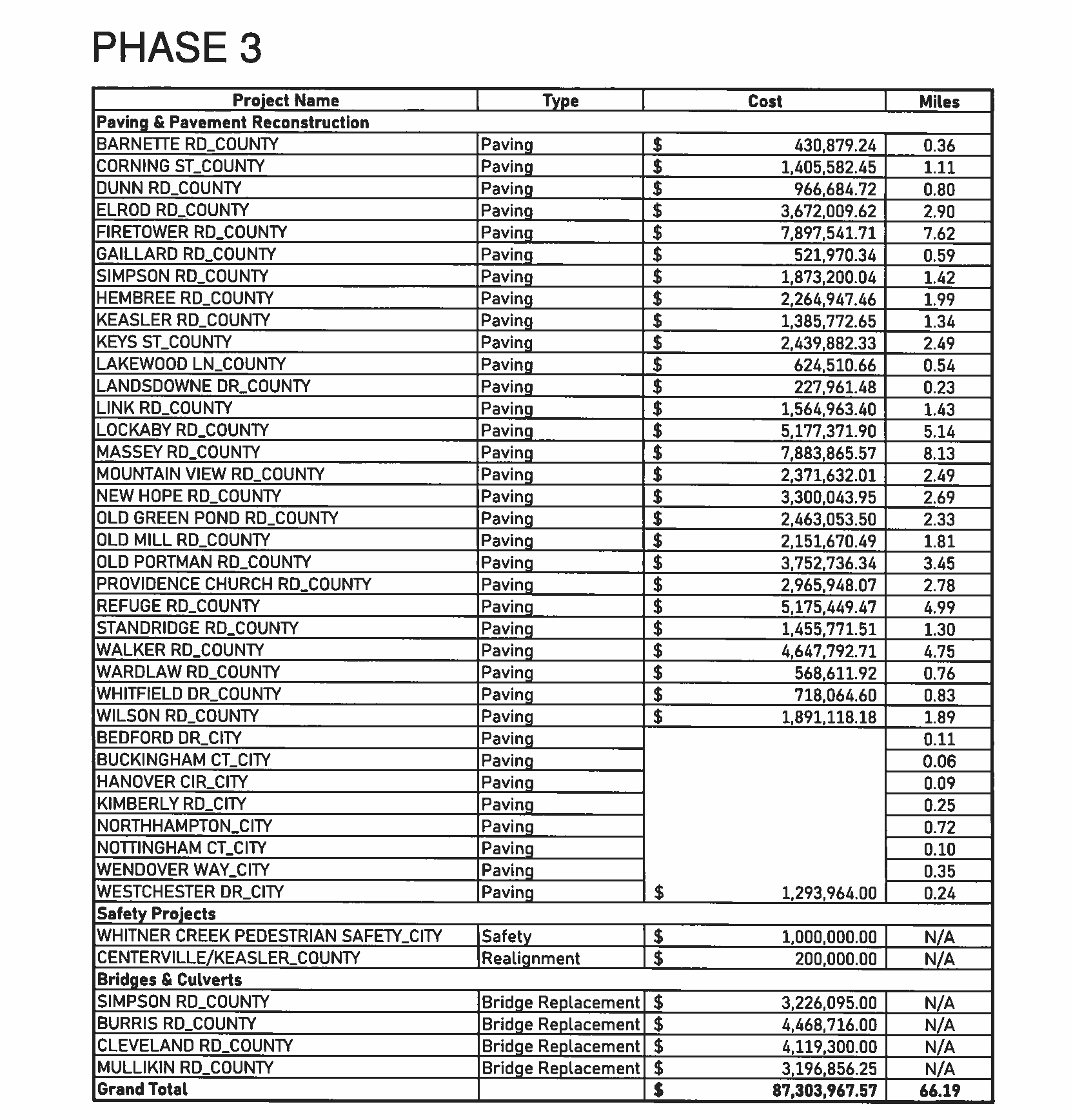

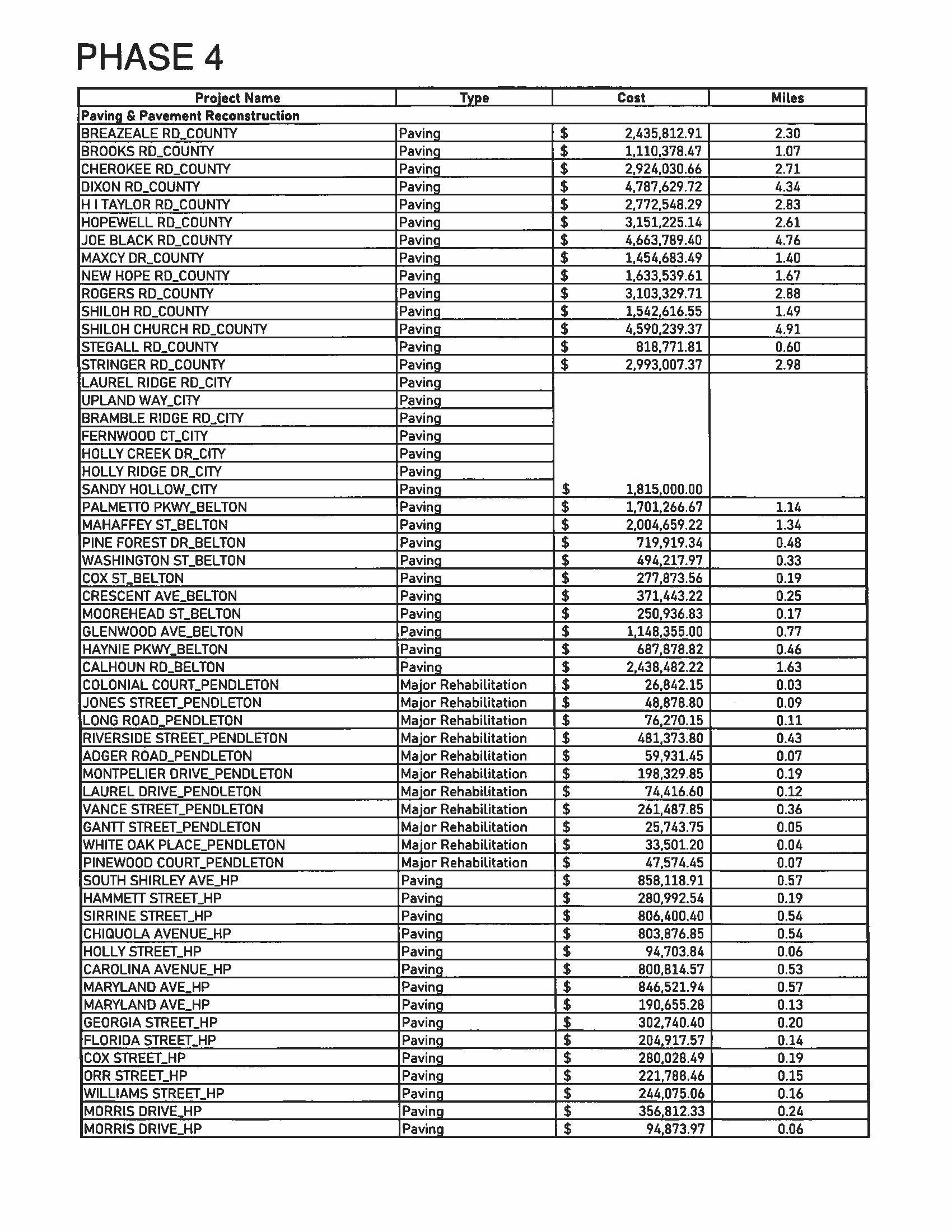

The projects are prioritized in Phases 1-4, and repairs on the list could move up under certain circumstances, such as grant money in a later phase or permit delays in a Phase 1 project.

Here is the final text of the ballot as approved by the commission Monday:

Ballot Question for Referendum on Capital Sales Tax for Road/Bridges Repair/Maintenance

Must a special one percent sales and use tax be imposed in Anderson County, South Carolina for eight (8) years to raise the amounts specified for the following purposes:

$277,999,013.62 for 271 paving and road projects including but not limited to:

Plantation Rd all County owned segments between E River St & Highway 29 N (Nevitt Forest Area)

Mt Airy Church Rd from Hwy 81 N to Three Bridges Rd (Powdersville Area) E Main St from S Mechanic St to Lebanon Rd (Pendleton)

First St from S Academy St to Town limits (Williamston)

N Main/ S Main St from Calhoun Rd to Guthrie Rd (Belton)

Dixon Rd from Whitehall Rd to Old Pearman Dairy Rd (Anderson County, Centerville) Keys St from Brookhaven Dr to Gleneddie Rd (Anderson City, Homeland Park)

Shiloh Church Rd from Hwy 17 to Hwy 86 (Anderson County) Breazeale Rd from Hwy 29 to Midway Rd (Belton)

Monitor Dr from Dobbins Bridge Dr to Lewis St (Anderson County) West Mauldin St from Main St to Bleckley St (Anderson City)

Broadway Lake Rd from the spillway bridge to Parnell Rd (Broadway Lake Area) Griffin Farm Rd from Jones Chapel Rd to Firetower Rd (Craytonville/Honea Path Area)

$49,381,436.30 for 18 safety projects including but not limited to:

Oak Hill Rd/Harriet Circle to address lack of turn lanes (Anderson County) Vandiver Rd Pedestrian Safety to address pedestrian safety (Anderson County)

Pine Top Rd/James Cox Rd/US 178 (Anderson Highway) to address offset intersection (Belton)

Centerville Rd/Keasler Rd to address lack of tum lanes and angle intersections (Anderson County, Centerville)

Calhoun St/Marchbanks Rd/Rogers Rd to address skewed intersection with high volume (Anderson City)

Concord Rd/King Rd/Reed Rd to address offset intersections and sight distance (Anderson

City)

$52,241,707.34 for 17 bridge/culvert projects including but not limited to:

• Scotts Bridge Rd over Jones Creek (Anderson County)

• Mullikin Rd over Little Garvin Creek (Pendleton Area)

• Durham Rd over Hurricane Creek (Anderson County)

• Parker Bowie Rd over Little Generostee Creek (Iva)

INSTRUCTIONS TO VOTERS: All qualified electors of the County desiring to vote in favor of imposing the tax for the stated purposes as outlined above shall vote "YES", and all qualified electors opposed to levying the tax shall vote "NO".

Yes [ ] No [ ]

Here is the final list of projects and their costs: